Inside the NBA Offseason: How the CBA Is Reshaping Roster Construction

Adapting to the New Financial Era in Basketball

The NBA’s newest Collective Bargaining Agreement isn’t just changing how much teams can spend—it’s fundamentally altering how franchises build, sustain, and project their rosters. As the league pivots toward financial discipline, some front offices are thriving while others face looming decisions.

Understanding How the CBA Affects Team Building

The CBA introduced changes aimed at creating more parity across the NBA. Rather than judge the agreement as a success or failure, it’s more insightful to understand how it reshapes the decision-making landscape for teams.

5 Key Financial Structures:

1. Salary Cap Increases

The salary cap is now growing more predictably, with expectations of an annual 10% rise through the 2029-2030 season. This allows for:

- More predictability in long-term financial planning

- Increased spending power

- Greater risk for overcommitting to expensive cores

2. Max Contract Percentages

- Under the old CBA, players could sign max contracts worth 25%, 30%, or 35% of the cap, depending on years of service.

- The new CBA maintains these thresholds, but with cap spikes, the actual dollar value becomes steeper.

- The NBA is built on star power. While the % of Max deals for these start players hasn’t changed, the effects of the first and second aprons (a de facto hard cap) crowd out roster flexibility.

3. Aprons Explained

The NBA introduced hard cap-like constraints in the form of two “Aprons.”

- First Apron: Slightly above the luxury tax line; triggers mild limitations

- Second Apron: Essentially a hard cap, bringing severe restrictions

4. First Apron (Estimates through 2029-2030)

| Season | First Apron Estimate |

| 2025-26 | ~$195M |

| 2026-27 | ~$214M |

| 2027-28 | ~$235M |

| 2028-29 | ~$258M |

| 2029-30 | ~$284M |

5. Second Apron (Estimates through 2029-2030)

| Season | Second Apron Estimate |

| 2025-26 | ~$206M |

| 2026-27 | ~$227M |

| 2027-28 | ~$250M |

| 2028-29 | ~$275M |

| 2029-30 | ~$302M |

Ramifications of Crossing the Aprons:

Teams above the first apron face restrictions like:

- Losing access to the mid-level exception

- Inability to sign buyout players who made above the mid-level elsewhere

Teams above the second apron face harsher penalties:

- No sign-and-trades

- No access to mid-level exception

- No ability to aggregate salaries in trades

- Picks seven years out frozen and potentially moved back in the draft order

Early Adopters Who Saw It Coming

Smart front offices began preparing for the CBA’s arrival years in advance. These franchises understood that the CBA would demand financial planning, cost-controlled talent, and optionality. They proactively positioned themselves to remain competitive while avoiding the harshest penalties of the new apron system.

Common threads define this group: young rosters built through smart drafting and value trades, veterans signed to team-friendly deals, and a deep resistance to locking into inflexible, top-heavy payroll structures. These franchises didn’t just adapt to the shifting rules—they used them as a competitive edge.

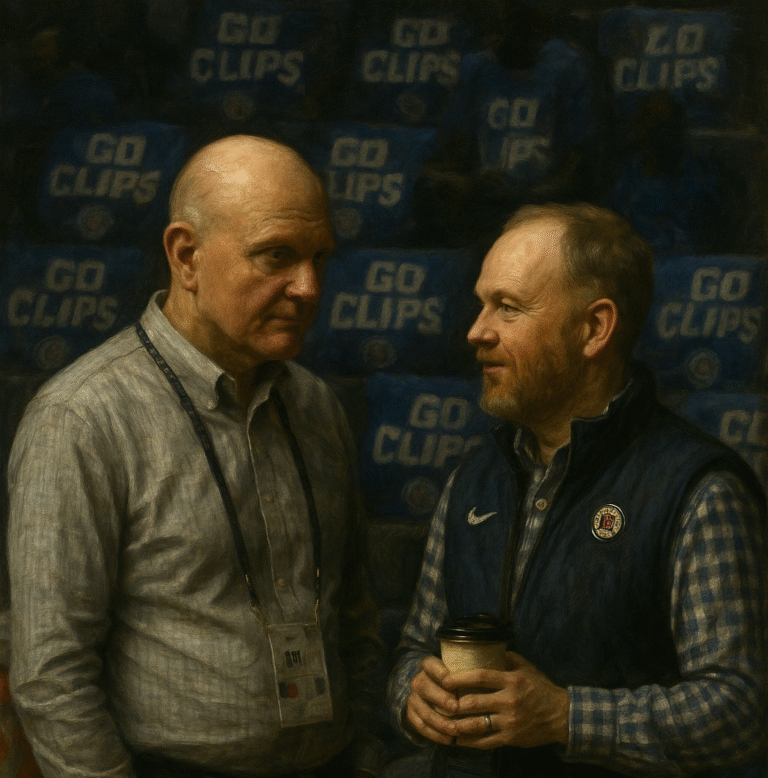

LA Clippers

- Allowed Paul George to walk last summer to avoid pushing up against the second apron

- They prioritized quality depth and cost-effective Free Agents

- Increased roles for Ivica Zubac and Norman Powell led to increased production

- They maintained flexibility while putting a competitive team around Kawhi and Harden

Oklahoma City Thunder

- They built an elite defensive rotation through smart trades and defense-first draft prosepcts

- Loaded with rookie-scale contracts: Jalen Williams, Chet Holmgren, Cason Wallace, Jalin Williams, and Nikola Topic

- Smart veteran adds like Alex Caruso and Isaiah Hartenstein (team control flexibility)

Houston Rockets

- Alperen Sengun and Jalen Green on team-friendly deals, below the max.

- Veteran contracts are short and/or team-friendly:

- Dillon Brooks (team-friendly with the increased cap)

- Fred VanVleet (team option after Year 2)

- Steven Adams (expiring, low cost)

- Still below the first apron with a competitive roster

These teams offer a blueprint: blend young, cost-controlled talent with flexible veteran contracts to dodge CBA restrictions.

Teams to Watch: The Dreaded Second Apron

While it’s too early to say that the days of paying your way to a championship are over, it sure feels that way. A ramification of a team overspending in the second apron is that they can no longer sign-and-trade for players during Free Agency. The Golden State Warriors, for example, would no longer have been able to complete the Kevin Durant sign-and-trade for D’Angelo Russell (who was eventually turned into Andrew Wiggins, a key player during their 2022 Championship run) during the 2019 offseason.

As we fast forward to impending Free Agency, not every team has navigated the CBA transition. Several high-spending franchises find themselves in murky situations: either course-correct or suffer the long-term consequences of second-apron inflexibility.

Whether it’s ballooning payroll (Boston and New York), diminishing trade capital (Phoenix), or aging cores (Milwaukee), the pressure is mounting. What these teams share is a looming dilemma: preserve optionality or risk future paralysis. Keep a close eye on this group—major changes could be just around the corner.

Boston Celtics

- Historic payroll with an injured Jayson Tatum on a supermax

- Already face massive tax bills

- Will need to move players like Jrue Holiday or Kristaps Porzingis to better position themselves long-term

Phoenix Suns

- Invested heavily in Kevin Durant and Bradley Beal

- No draft capital left to replenish depth

- Stuck above second apron: no mid-level exception, no salary aggregation

- Top-heavy with little flexibility

New York Knicks

- Emerging contenders, but pushing the payroll line

- Jalen Brunson, Karl-Anthony Towns, Mikal Bridges, and OG Anunoby— these players are on large contracts, have extensions kicking in, or will be expecting extensions soon

- A decision looms: go into the apron for short-term gain or cash in on one of these players to preserve optionality

What to Expect This Summer

“This could be the most impactful offseason in NBA history.” – Shams

That might sound like hyperbole—but it isn’t. The effects of the new CBA and widening disparity between conferences have put the league on the edge of sweeping change. Every front office is now operating with sharper consequences for financial overreach, and the trade market is expected to erupt accordingly.

Expect a wave of significant trades, including multiple All-Star-level players changing teams. The twin catalysts are clear: First, the punitive nature of the new CBA makes it almost impossible to remain competitive while operating above the second apron. Second, the imbalance between the East and West is forcing teams to reassess timelines.

The West is undeniably deeper—a gauntlet of playoff-caliber teams even outside the top five. That’s why franchises like Sacramento, New Orleans, and Memphis will consider a teardown or serious retool. In the East, the inverse is true. Beyond Boston (even with the Tatum injury), Cleveland, Indiana, and New York, there’s reason to believe that a handful of teams are primed for a quick ascension. That’s why teams like Brooklyn, Atlanta, Miami, and Toronto are likely to pursue aggressive upgrades. In the West, those same rosters would likely be lottery-bound.

A New Era of Team Building

The new CBA didn’t arrive with a bang, it arrived with a calculator. Teams aren’t just building for star power anymore—they’re building for survival while suffocating under the financial pressure. The franchises best prepared for this new environment are the ones that adapted before they had to.

This summer isn’t just a spectacle. It’s a reckoning. Not a holiday for fans, but a chaotic series of league-altering transactions the likes of which we’ve never seen—and may never see again.

If the past few years were defined by star chases and superteams, this era is about creativity, timing, and fiscal discipline. Front offices that move early and smartly will reshape the power structure of the league—not with flashy signings, but with strategy.

There’s no predicting this offseason. Turn on Shams’ tweet notifications, bookmark your favorite NBA podcasts, and enjoy the ride.

Related Posts

Champions League: 2026 Rookie Mock Draft 1.0

The 2026 rookie class is deeper than consensus suggests, with quarterback volatility at the top and wide receiver depth reshaping the mid-first. TRS Insiders break down the intel, the tiers, and a full first-round mock as draft season accelerates.

The Rocker Step Dynasty League Draft Recap

First-round quarterbacks swapped, elite veterans slid into unexpected ranges, and future rookie capital was leveraged early and often.